Companies angling to take advantage of new tax credits in the Inflation Reduction Act for making clean hydrogen are asking lots of questions.

Some of the questions will have to await guidance from the US Treasury.

The Treasury is expected to ask imminently for comments on the new hydrogen credits as a precursor to writing guidance.

A “clean hydrogen production standard” that the US Department of Energy proposed in early October answered at least one of the questions.

Two Options

The IRA gives anyone producing “clean hydrogen” the choice of production tax credits of up to $3 a kilogram for 10 years on the hydrogen produced or an investment tax credit of up to 30% of the cost of the electrolyzer and other equipment.

The investment tax credit is claimed entirely in the year the electrolyzer or other equipment is put in service. The hydrogen producer must choose between the two credits. It cannot claim both.

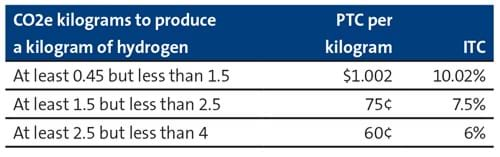

The credit amounts vary depending on the greenhouse gases emitted to produce a kilogram of hydrogen. The greenhouse gases are converted into CO2-equivalent emissions.

To claim credits at the full rate, the production process must lead to less than 0.45 kilograms of CO2-equivalent emissions per kilogram of hydrogen.

The following table shows the tax credit amounts where the CO2-equivalent emissions exceed that amount.

No credits can be claimed on hydrogen produced with more than four kilograms of CO2 emissions per kilogram of hydrogen.

The CO2 emissions are measured on a lifecycle basis, meaning taking into account all of the emissions from feedstock through the point the hydrogen is produced (rather than also through consumer use). Hydrogen producers can petition the IRS to determine their lifecycle emissions rates.

The production tax credit amount will be adjusted annually for inflation using 2022 as the base year for measuring inflation.

Production tax credits can only be claimed on hydrogen produced in 2023 or later.

The hydrogen must be produced for sale or use as hydrogen, and the quantity sold or used must be verified by a third party.

The hydrogen must be produced in the United States or a US possession like Puerto Rico.

Production tax credits cannot be claimed on hydrogen produced at a facility that is owned by one company and used by another company. An example is where company A owns a plant and leases it to company B to be used to make hydrogen. The owner and user must be the same company for tax purposes. This is not a barrier to claiming an investment tax credit.

Hydrogen PTCs may be claimed for 10 years starting on the date the facility is originally placed in service. Thus, a facility put in service before 2023 will have used up part of the 10-year period by the time it is able to start claiming tax credits. However, a facility that was not producing clean hydrogen before 2023 and that is modified in 2023 or later to produce such hydrogen can treat the 10 years as starting when the improvements are placed in service.

Hydrogen producers will have the option to be paid the cash value of production tax credits — but not the investment tax credit, if that option is selected — under an IRS refund process, but only for the first five tax years of credits commencing with the tax year the producer places the hydrogen plant in service. The five-year period cannot stretch beyond 2032. Tax credits after the refund period ends can be sold to other companies for cash (as can investment tax credits). (For more details on transferring tax credits, see “Searching for Opportunities in the Inflation Reduction Act” in the August 2022 NewsWire.)

An investment tax credit cannot be claimed on a hydrogen plant put in service before 2023 or on tax basis built up before 2023 where the plant was already under development or construction before 2023.

However, it appears that one benefit of claiming an investment credit is the ability to claim bonus credits for hydrogen plants in “energy communities” or that use domestic content that could increase the hydrogen ITC to as high as 50%. (For more details, see “Searching for Opportunities in the Inflation Reduction Act” in the August 2022 NewsWire.)

Projects must be under construction by the end of 2032 to qualify for hydrogen tax credits.

The tax credits will be only a fifth of the full rate unless mechanics and laborers working on the project are paid at least “prevailing wages” as determined by the US Department of Labor and qualified apprentices are used for at least 10% (increasing to 15%) of total labor hours, both during construction and when making any repairs or alterations during the full period production tax credits are claimed or, where an investment tax credit is claimed, during the five-year period the ITC is subject to recapture. Apprentices are supposed to be used to train more workers for jobs in the green economy. (For more details, see “Wage and Apprentice Requirements” in the October 2022 NewsWire.)

The IRA allows owners of wind, solar and other renewable energy and nuclear power plants to use the electricity they generate in 2023 or later to make clean hydrogen and still claim separate PTCs on the electricity output, thus doubling up on PTCs for generating wind, solar, geothermal or nuclear electricity and then using the electricity to make green hydrogen. Normally, PTCs can only be claimed if the electricity is sold to an unrelated person.

However, care must be taken not to lose depreciation on the power plant. Tax losses cannot be claimed on property sold to an affiliate. Electricity is considered property for this purpose. Many renewable energy power plants have tax losses for the first three years on account of front-loaded depreciation. (For more details, see “Section 707(b): Related-Party Electricity Sales” in the June 2021 NewsWire and “Utility Tax Equity Partnerships” in the August 2021 NewsWire.)

Common Questions

Companies planning to make clean hydrogen are asking a number of questions.

One is whether tax credits can be “stacked,” for example by claiming hydrogen PTCs or a hydrogen ITC, section 45Q credits for capturing the carbon emissions and section 45Z credits for making sustainable aviation or other clean transportation fuels. The answer is no if done at the same “facility.” The Treasury will have to address what happens if the hydrogen plant and the carbon capture or fuel production equipment are owned by different parties.

Another frequent question is whether projects can buy renewable energy credits or enter into virtual power purchase agreements with renewable energy projects to offset emissions from using grid electricity.

Senator Tom Carper (D-Delaware) asked Senator Ron Wyden (D-Oregon), the floor manager for the Inflation Reduction Act tax provisions, that question shortly before the Senate vote in August. Carper asked whether the intention is to allow hydrogen producers to use “indirect accounting factors” such as RECs, renewable thermal credits, renewable identification numbers (RINs) and biogas credits to reduce effective greenhouse gas emissions. Wyden said yes.

There are rumors that any such ability to claim RECs as offsets may be limited to renewable energy projects in the same geographic area, possibly by balancing authority. There are 66 separate balancing authorities in the US.

The US Department of Energy issued a proposed clean hydrogen production standard, called “CHPS,” for comment in October on which the IRS is likely to rely. One question the department asked is whether “renewable energy credits, power purchase agreements, or other market structures” should be taken into account as potential emissions offsets and, if so, whether there should be “restrictions on time of generation, time of use, or regional considerations.”

DOE said that CHPS is not a regulatory standard, but that it aligns with the hydrogen tax credits. The department has $8 billion in grant money to award to six to 10 hydrogen hubs. It said it may still select some projects that have higher emissions than the CHPS standard to qualify as clean hydrogen, but that still help reduce greenhouse gas emissions across the supply chain.

DOE gave two examples of where it thinks projects would fall on the emissions spectrum.

It said that it expects electrolysis systems can limit lifecycle emissions to approximately four kilograms of CO2 equivalent per kilogram of hydrogen produced by limiting grid electricity to about 15% of total power used. It said a steam methane reformer that uses all grid electricity, with average US emissions for such electricity, should be able to do so as well by capturing and sequestering 95% of its carbon emissions and limiting upstream methane emissions to 1%.

Hydrogen producers have been asking whether tax credits can be claimed where hydrogen is produced as an intermediate chemical in a step toward producing a different end product. The Treasury will have to decide in guidance. One issue is how this differs from the case where hydrogen is produced and then converted into ammonia for transport where tax credits can be claimed.

DOE suggested in its CHPS standard that hydrogen produced as a byproduct of another process may qualify as clean hydrogen — for example, in chlor-alkali production and petrochemical cracking — but asked what companies normally do with such hydrogen and how much of the greenhouse gas emissions associated with the larger process should be allocated to the hydrogen.

Another frequent question is whether emissions from using grid electricity to liquefy or compress hydrogen for transportation must be taken into account as part of the lifecycle emissions. DOE said no. It said its CHPS uses the same lifecycle emissions boundary as used for the hydrogen tax credits.

The boundary includes “upstream processes (e.g., electricity generation, fugitive emissions), as well as downstream processes associated with ensuring that CO2 produced is safely and durably sequestered.” Emissions associated with sequestration off site are taken into account. However, “other post-hydrogen production steps such as potential liquefaction, compression, dispensing into vehicles, etc.” are not taken into account, DOE said. It said more than 20 countries are working to harmonize how their calculations are done.

Some types of fuels can have negative emissions. This would be true of things like municipal garbage and animal waste that would otherwise have been disposed of in ways that produce large greenhouse gas emissions if not used for hydrogen production. DOE asked for help figuring out how to quantify the negative emissions.

It also asked how emissions should be allocated among hydrogen and other co-products that are produced at the same time, such as steam, electricity, elemental carbon and oxygen.